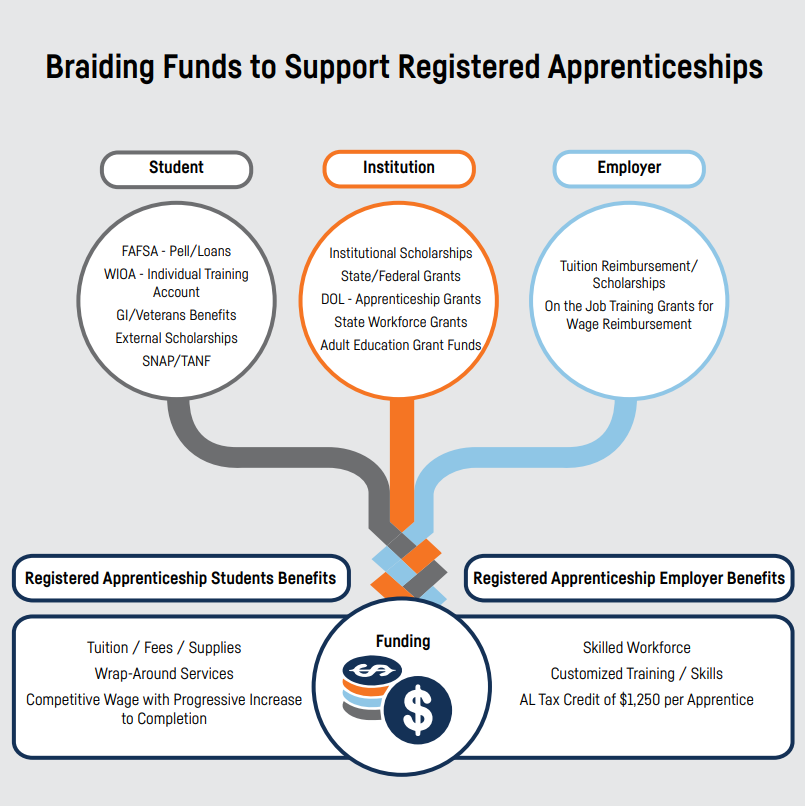

Alabama Governor Kay Ivey established the Alabama Office of Apprenticeship in 2019 with a focus on establishing a robust registered apprenticeship program to support her goal of adding 500,000 credentialed employees to Alabama’s Workforce by 2025. Wallace State (WSCC) made a commitment to make significant investments to design and execute apprenticeship programs for its students and our employer partners. WSCC currently has 53 active registered apprentices in partnership with 15 different companies, primarily in advanced manufacturing. The college has developed and implemented these apprenticeships through a system of braided funding, which provides support for the student, employer, and the institution.

Registered Apprenticeship Student Benefits

WSCC has leveraged funding from two Department of Labor Apprenticeship grants to provide support for personnel who recruit, enroll, advise, and provide success coaching to registered apprentices. As students are accepted into a registered apprenticeship, the registered apprenticeship coordinator (AACC ECCA) and FAME apprenticeship/success coach (ALAMAP) work with each student to complete an intake form to determine their financial need and eligibility for support. The apprenticeship coordinators conduct an orientation which includes the completion of the FAFSA, meetings with the financial aid personnel, and the Alabama Career Center to determine WIOA eligibility. All these options are discussed, and applications submitted for assistance as applicable. This allows the student to access support funding of not only tuition/fees, books/tools/uniforms, but also basic needs and wrap-around services including transportation, meals, and childcare.

The ALAMAP grant has also provided equipment to support the RTI specific to the employer sponsors. Leveraging funds from state workforce grants has enabled the acquisition of equipment and partnerships with the Adult Education programs provides funding support for pre-apprenticeship programs.

Registered Apprenticeship Employer Benefits

The registered apprenticeship employers are responsible for covering the cost of tuition and fees as it relates to the required related technical instruction (RTI) costs. The goal is for this to be last-dollar support for the apprentice after Pell, WIOA, scholarships, and can be covered through tuition reimbursement to the student or scholarship. Employers can also access OJT grants through the state to support up to 50% of the wages paid to the registered apprentice or through Incumbent Worker Training grants which provide a 50% match on training costs for employees who have worked for the employer at least six months. Additionally, as a part of the emphasis on apprenticeships in Alabama, the legislature passed the State Apprenticeship Tax Credit, which provides a $1,250 tax credit for every apprentice employed for at least seven months in the calendar year.

Best Practice:

Registered apprenticeship partner, Kamtek, onboards a cohort group of 15 apprentices annually in tool & die, mechatronics, machine tool technology, and diesel mechanic occupations. Each student is provided with uniforms, tuition/fees scholarships, and a competitive wage. Kamtek submitted and was approved for an OJT grant and receives reimbursement of 50% of the wages paid to the registered apprentices. As one of the primary partners in the WSCC AACC ECCA project, the grant covers the cost of the apprenticeship coordinator who guides the apprentices, assists with the completion of the employer reporting, and serves as a liaison between the college, the apprentices and the employer.